listen to the show

http://www.radio-shalom.ca/mp3/Programs/1042/1419.mp3

Jeffrey Feldman

Shalom Radio CJRS1650AM in Montreal

Money and Business show / Samuel Ezerzer

February 1rst 2012 AT 4PM

http://www.radio-shalom.ca/EN/showemission.php?ID=1042

As well we will have The Honourable Peter Van Loan

Leader of the Government in the House of Commons to discuss Pooled Registered Pension Plans

INTRODUCTION

Have you heard about ETFs, but aren’t really sure what they are? Then you can hear todays show where we are going to learn some of the basics about ETFs and how they can benefit your portfolio specifically exchange traded funds in the healthcare and biotechnology. Exchange Traded Funds are an up-and-coming investment vehicle because of their advantages of other investments such as mutual funds. They have lower cost structures, are easy to trade, and have a lesser impact on your tax bill.

The children of the baby boomers were born between 1976 and 1994 (the so-called "millennial"). There are 76 million of them and the oldest turned 35 in 2011. We will now add 76 million people to the investor demographic over the next 18 years. Where the baby boomers had mutual funds, the millennial have ETFs. ETF assets have grown from $50 billion in 2005 to $1.2 trillion today and will grow to $5 trillion by 2020. So if you’re ready intrigued, stayed tuned we have live from Florida is Mr. Jeffrey Feldman a wall street veteran for 42 years, founder and chief strategist for the XShares Group, an ETF company that was sold to Deutsche Bank in 2010 he has also been teaching economics nearly all of that time as well. He will discuss today "Investment Opportunities in Healthcare and Medicine." Why health care ETF or specifically biotechnology Exchange traded funds is the best way to profit as the baby boomers retire and are these exchange traded funds retirement vehicles for seniors or more appropriate to younger investors?

listen to the show

http://www.radio-shalom.ca/EN/player.php?URI=/../mp3/Programs/1042/1418.mp3

My name is Samuel Ezerzer, your host to the Money & Business show on Radio Shalom, CJRS 1650 AM. Thank you for tuning in live on the Money & Business show, with our Business studios headquarters in Montreal, the financial capital and the home to the greatest hockey team, the Montreal Canadians. We have another great show for you today and as always, you can call if you have any questions, comments, or criticisms on today's topic. Please call us direct at 514 738 4100 ext 200 or email me at moneyandbusinessshow@gmail.com if you have any inquiries. You can also visit our website at www.radio-shalom.ca– all our shows are archived there.

The children of the baby boomers were born between 1976 and 1994 (the so-called "millennial"). There are 76 million of them and the oldest turned 35 in 2011. We will now add 76 million people to the investor demographic over the next 18 years. Where the baby boomers had mutual funds, the millennial have ETFs. ETF assets have grown from $50 billion in 2005 to $1.2 trillion today and will grow to $5 trillion by 2020. So if you’re ready intrigued, stayed tuned we have live from Florida is Mr. Jeffrey Feldman a wall street veteran for 42 years, founder and chief strategist for the XShares Group, an ETF company that was sold to Deutsche Bank in 2010 he has also been teaching economics nearly all of that time as well. He will discuss today "Investment Opportunities in Healthcare and Medicine." Why health care ETF or specifically biotechnology Exchange traded funds is the best way to profit as the baby boomers retire and are these exchange traded funds retirement vehicles for seniors or more appropriate to younger investors?

listen to the show

http://www.radio-shalom.ca/EN/player.php?URI=/../mp3/Programs/1042/1418.mp3

My name is Samuel Ezerzer, your host to the Money & Business show on Radio Shalom, CJRS 1650 AM. Thank you for tuning in live on the Money & Business show, with our Business studios headquarters in Montreal, the financial capital and the home to the greatest hockey team, the Montreal Canadians. We have another great show for you today and as always, you can call if you have any questions, comments, or criticisms on today's topic. Please call us direct at 514 738 4100 ext 200 or email me at moneyandbusinessshow@gmail.com if you have any inquiries. You can also visit our website at www.radio-shalom.ca– all our shows are archived there.

Biography

Jeffrey Feldman, a 42-year veteran of Wall Street, started his career at Goldman Sachs in 1970. Most recently, he was founder and chief strategist for the XShares Group, an ETF company that was sold to Deutsche Bank in 2010. XShares created ETFs in the healthcare/biosciences sector and partnered with TD Ameritrade on a series of target-date ETFs. Jeff has taught courses in finance and economics at various universities and community colleges in New Jersey. He has been a popular speaker at professional and investor conferences including The Money Show, The Milken Institute, and the American Association of Individual Investors.

Jeff, along with co-author Andrew Hyman, wrote Three Paths to Profitable Investing, Using ETFs in Healthcare, Infrastructure, and the Environment to Grow Your Assets (May 2010, FT Press, Financial Times).

Jeff has an MBA in Finance from St. John’s University and a BA in Economics and Mathematics from Queens College, C.U.N.Y.

Small talk

Jeff, along with co-author Andrew Hyman, wrote Three Paths to Profitable Investing, Using ETFs in Healthcare, Infrastructure, and the Environment to Grow Your Assets (May 2010, FT Press, Financial Times).

QUESTIONS

1. Over the long-term, earnings growth drives the stock market forward. In 2011, earnings growth was likely in excess of 13%, well ahead of the approximately 7% long-term average. Despite this earnings performance, the S&P 500 index was virtually unchanged on the year. Fears of a double-dip recession in the United States and uncertainties surrounding the outcome of the European debt crisis led to a volatile year of trading. Jeff what is your outlook for the markets in 2012 and do you see a similarity of the 1970’s when investors where buying hard assets such as oil and precious metals?

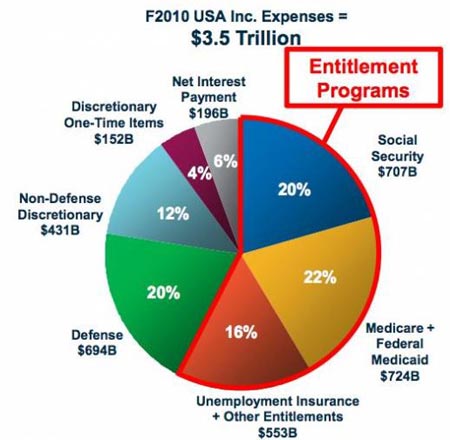

2.According to a report last year from the economists at the Centers for Medicare and Medicaid Services, federal spending on health care grew faster than private spending in 2012, as more people fell off private insurance rolls and signed up for Medicaid. Due to the recession, the federal government spent about $500 billion on Medicare and the federal government and states spent some $380 billion on Medicaid. These two programs accounted for about one-fifth of the entire federal budget.

Is one of the reason is - as more baby boomers grow old enough to qualify for Medicare, that program is on track to grow even more?

Jeff- Yes. Individuals under the age of 65 spend 6% of disposable personal income on healthcare. People over 65 spend 17% of their income on health (including medicare contribution). the over 65 population will quadruple between now and 2030.

3. Jeff you wrote in your book that you called the children of the boomers Millennial , there are 76million of them and you mentioned that the baby boomers had stocks and mutual funds in there portfolios , whereas their children now own and trade Exchange traded funds?

jeff-(The children of the baby boomers were born between 1976 and 1994 (the so-called "millennial"). There are 76 million of them and the oldest turned 35 in 2011. We will now add 76 million people to the investor demographic over the next 18 years. Where the boomers had mutual funds, the millennial have ETFs. ETF assets have grown from $50 billion in 2005 to $1.2 trillion today and will grow to $5 trillion by 2020.)

4. Jeff Obviously you are particularly interested in medicine as an investment and as an asset class? Has Wall Street and most money managers missed something here?

Jeff - I will explain in detail. Medicine is not yet an asset class even though healthcare is 17% of GDP and growing. Agricultural commodities ARE an asset class and agriculture is less than 1% of GDP. Healthcare is a remarkably under invested space for many reasons.

5.IYH Dow Jones U.S. Healthcare Sector Index Fund , why is IYH is weighted heavily toward big pharmaceuticals. ?

Jeff -The 12 major pharmaceutical companies have a total market cap of $1.5 trillion and the 400 biotech companies that are public have a total market cap of less than $500 billion. But the pharmaceutical companies are facing a "patent cliff" losing 40% of their patent protected sales by 2014. At the same time, personalized medicine is emerging as the new model, replacing the pharmaceutical model of broad based blockbuster drugs. There are over 5000 products in late stage trials in the US and nearly 70% of those trials are not being done by big pharma companies. It stands to reason that the market cap growth of the industry will be driven by the smaller companies.

(You asked about IYH. IYH is weighted heavily toward big pharmaceuticals. The current business model for them is to treat symptoms. If you develop high cholesterol, they wll give you a pill every day to lower it. Disease is treated chronically. Chronic is a good business model for an oligopoly especially if there are a reasonable number of customers.But today, in the US. We have 130 million people with chronic conditions. We can no longer afford to treat all those symptoms. Genomic and gene mapping allow us to find the underlying cause of disease. Today Isis Pharmaceuticals has a drug in trials called mimopersen which intends to alter one's DNA so as to prevent the over-manufacture of cholesterol. Many companies are working on cancer vaccines that are gene-based. The biotech industry is trying to prevent the symptoms, rather than treat them. The diagnostics industry is evolving to become about prognosis (figure out what will be wrong in the future) instead of determing what has already happenned to the body. The companies in the IYH are about the history of medicine. The biotech industry is about the future omedicine. I have started a new firm, Modern Medicine Capital Advisors, which is creating a series of publicly traded funds to allow investors to partcipate in the new technologies and eventually, I hope these funds will define medicine as an asset class.)

---------------------------------------------------------------------------------------------------

The iShares Dow Jones U.S. Healthcare Sector Index Fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of U.S. healthcare stocks, as represented by the Dow Jones U.S. Health Care Index.

Top Holdings*as of 1/30/2012 View all holdings

Name % of Fund

JOHNSON & JOHNSON 11.82%

PFIZER INC 10.91%

MERCK & CO. INC. 7.86%

ABBOTT LABORATORIES 5.58%

AMGEN INC 3.94%

BRISTOL-MYERS SQUIBB CO 3.64%

UNITEDHEALTH GROUP INC 3.61%

MEDTRONIC INC 2.71%

ELI LILLY & CO 2.53%

GILEAD SCIENCES INC 2.40%

Total 55.00%

Sector Breakdown as of 1/30/2012* View all holdings

Sector % of Fund

&Pharmaceuticals & Biotechnology 63.77%

&Health Care Equipment & Services 36.10%

S-T Securities 0.03%

Other/Undefined 0.10%

6."The combined profits for the ten drug companies in the Fortune 500 ($35.9 billion) were more than the profits for all the other 490 businesses put together ($33.7 billion) [in 2002]. Over the past two decades the pharmaceutical industry has moved very far from its original high purpose of discovering and producing useful new drugs. Now primarily a marketing machine to sell drugs of dubious benefit, this industry uses its wealth and power to co-opt every institution that might stand in its way, including the US Congress, the FDA, the academic medical centers, and the medical profession itself." How did they get so powerful?

Jeff -The pharmaceutical industry is a well established late stage oligopoly. Oligopolies loathe innovation and protect their margins. They can only be moved aside by creative destruction which starts with capital formation (investing in new companies, something we have failed to do of late). But consider this; The most powerful oligopoly in the US in the 1960s was the steel industry. At the end of the decade, plastics became commercial and the import laws were relaxed and within a decade, US Steel and Bethlehem Steel were bankrupt. In the 1970s we had a saying in the US- "As GM goes, so goes the nation." We had energy shocks, gas became expensive and the Japanese took over. Eventually GM went bankrupt. In the 1980s, the only way you could make a long distance telephone call was on AT&T. The phone industry was deregulated in 1986 paving the way for the new wireless carriers. AT&T nearly went bankrupt and had to be restructured.

In the 1990s, if I asked you to name the great airlines, you would have likely said TWA, PANAM, Eastern and American. The largest Airline in the US today is Jet Blue. The others have all gone bankrupt.

In 2002 scientists mapped the human genome which allows for pharmaco-genomic medicines to atttack disease. It is a very different model that the broad-based blockbuster treatments of symptoms. The pharmacutical industry will just be the next in line to fall.

http://www.wanttoknow.info/truthaboutdrugcompanies

7.Can you discuss the specific technologies such as RNAI (RNA interference whereby medicines get the body to shut off genes that are causing unwanted effects). If the RNAi system in our bodies already is so powerful that it has the ability to silence a disease or virus gene, why do we get sick or have diseases at all?

I don't understand exactly how RNAi could treat or cure HIV/AIDS or other viruses. Would RNAi target the patient's genes, or would it work on the genes of the AIDS virus in order to suppress it?

Could RNAi have an application for preventing overall aging of the body?

http://www.youtube.com/watch?v=kCxQdXX0Dbk

RNA interference (RNAi) is a naturally occurring mechanism that leads to the “silencing” of genes. In consequence, the respective protein is no longer synthesised. In nature, this mechanism is used for the regulation of specific genes and is also applied as a defence against viruses. In research, this technique can be used for loss-of-function studies where a gene is specifically silenced and the impact of this loss is analysed in cells or whole organisms. This can be performed under normal conditions or in the context of a disease.

The importance of this technology is reflected by the fact that the 2006 Nobel prize for medicine was awarded for the discovery of RNA interference by Craig Mello and Andrew Fire.

On the websites of the Nature Publishing Group you can find an animated tour through the processes of RNA interference. Please click here

http://plone.org/http://plone.org/

8. Jeff which ETFs are best for investors to participate in healthcare, green technologies, alternative energy and infrastructure?

9.The Pros use a variety of hedging techniques to protect their portfolios in the event of a broad market sell-off, and thanks to the proliferation of exchange-traded funds (ETFs), it is now easier than ever for retail investors to do the same? Do you like inverse ETF’s for protection in case markets fall? (ProSharesShort QQQ ETF (AMEX:PSQ) seeks results that correspond to the inverse of the performance of the Nasdaq 100 Index. If you anticipate a downturn in the Nasdaq 100, you would simply buy shares in PSQ. )

Recomandations by Jeffrey Feldman

to buy

Jeffrey Feldman Notes

When I wrote my book, which I began in 2009, we were still in the throes of the economic crisis. In large part, the crisis stemmed from the failure of the capital markets to do their job, namely creative destruction and capital formation. Instead, the markets became casinos for a wide variety of meaningless bets. This has happenned before. In the late 1970s for example, investors abandoned capital formation to invest in hard assets such as oil, precious metals and agricultural commodities. I point out that 2012 feels a lot like 1982 to me for several reasons. As we began 1982, investors were focused on inflation, recession (stagflation) and a general lack of productivity. But by the end of the decade, the greates bull market in history was underway as we roared into the Information Age. Capital formation underpinned that growth as the advent of mutual funds converged with the coming-of-age of the baby boom generation and the introduction of the personal computer. It took sveral years but society came to understand that the world was not ending and , in fact, the future was bright. The Dow, which was 1000 in 1967 and was still 1000 at the beginning of 1982, soared to 10,700 by 2000. Since 2000, we have had no analogy to the introduction of the computer while at the same time many of the baby boomers have aged out of the investor demographic (70% of all stocks are owned by people 35 to 55 years of age). The baby boomers in the US were born between 1946 and 1964 (78 million people). The oldest of them tuned 35 in 1981 and the remainder reached their 35th birthday over the next 18 years. So we added 78 million people to the investor demographic between 1982 and 2000 (exactly the years of the bull market). Starting in 2000, boomers started aging out of that demographic and the birth rate in the US between 1964 and 1976 was very low, so there were not enough replacements.

The children of the baby boomers were born between 1976 and 1994 (the so-called "millennials"). There are 76 million of them and the oldest turned 35 in 2011. We will now add 76 million people to the investor demographic over the next 18 years. Where the boomers had mutual funds, the millennial have ETFs. ETF assets have grown from $50 billion in 2005 to $1.2 trillion today and will grow to $5 trillion by 2020. In addition, other exchange traded products will allow individuals to invest in earlier stage companies as well as private companies (to engage in capital formation). This will democratize the markets and disinter rmediate the investment process (we no longer need private equity and venture funds). Where boomers had the Information Age driving innovation, we have now enetered what will come to be known as the Molecular Age, where new technologies which revolutionize healthcare, energy and infrastructure (as I write in my book). So, just as in 1982, we have the convergence of a new investor generation, new investment products and great new technologies that require funding. This will launch the greates bull market in human history and usher in a period of monumental prosperity.

I always look for evidence to support my premise. Below are two article's from todays's Wall Street Journal. I think you will agree they suppport my contention.

You can ask me what my outlook for the markets and economy is. You can ask me for specific examples of the new technologies. I am particularly interested in medicine as an investment. I believe it should be an asset class. You asked about IYH. IYH is weighted heavily toward big pharmaceuticals. The current business model for them is to treat symptoms. If you develop high cholesterol, they wll give you a pill every day to lower it. Disease is treated chronically. Chronic is a good business model for an oligopoly especially if there are a reasonable number of customers. But today, in the US. We have 130 million people with chronic conditions. we can no longer afford to treat all those symptoms. Genomic and gene mapping allow us to find the underlying cause of disease. Today Isis Pharmaceuticals has a drug in trials called mimopersen which intends to alter one's DNA so as to prevent the over-manufacture of cholesterol. Many companies are working on cancer vaccines that are gene-based. The biotech industry is trying to prevent the symptoms, rather than treat them. The diagnostics industry is evolving to become about prognosis (figure out what will be wrong in the future) instead of determing what has already happenned to the body. The companies in the IYH are about the history of medicine. The biotech industry is about the future omedicine. I have started a new firm, Modern Medicine Capital Advisors, which is creating a series of publicly traded funds to allow investors to partcipate in the new technologies and eventually, I hope these funds will define medicine as an asset class.

SAMUEL EZERZER

No comments:

Post a Comment